Remaining relevant in the future will require wine businesses to "listen genuinely and see the world through the eyes of our consumers", says wine business strategist Lulie Halstead.

The founder and former Chief Executive of Wine Intelligence spoke at the New Zealand Wine 2025 Wine Business Forum in Christchurch in August, sharing insights into consumer trends to help wine businesses "be resilient, relevant, and ready" for the future.

At the heart of her message was a reminder that "we are not our consumers", reiterating a warning she gave at the inaugural Wine Business Forum in 2023, which she attended virtually: "They do not care as much as we would like them to." In the latest forum Lulie showed the room of industry experts images from the "real world", including rosé being drunk straight from the bottle at a festival, and sparkling wine out of plastic glasses. Remaining relevant in the future will require businesses to listen to "real people" and better understand what they want, she said.

Key trends she is observing from data sources include the move to mindful consumption rather than abstinence. That means it is not just about alcohol intake, but also about processing and ingredients. The set includes "zebra striping", where consumers might start with a glass of sparkling wine, then move to a low alcohol beef, Coke or water, then back to full strength alcohol. Lulie also noted that when people switch away from wine to reduce alcohol consumption, water is the number one substitute, followed by tea and coffee.

Another key trend is low-fi dining, which is "changing how we're eating, what we're eating, where we're eating, and when we're eating". There's a growth in "low tempo" non-food occasions with alcohol consumption at home and out, Lulie said. "We're more frequently drinking alcohol without traditional food rituals." Meanwhile, restaurant reservation times are changing, with 6 o'clock the new 8 o'clock from New York to London. The casualisation of food represents a shift for the wine sector, which has traditionally been associated with at-table meal occasions and sharing with others, she said. "That is not going to be nearly as relevant in the future as it is today."

The third trend is "made for me" based on the desire for convenience. People increasingly have instant access to tailored products, "and we're getting really, really used to having that," Lulie said. In the United States, for example, nearly 60% of alcohol drinking occasions are now either solo or with one other person. There's an increase in single adult households in countries including the United Kingdom, Australia and US, which poses a challenge for wine. Building on that topic in the Q&A session, Lulie said consumers were increasingly open minded about alternative formats and serve size, giving an example of 2.25 litre bag-in-a-box wine in Florida retirement communities, and touching on improving technology around cans. The glass bottle will remain, "but the opportunity for building growth will also come from alternative sizes and container types".

Trend number four is "baseline sustainability", Lulie said, explaining that it is now a condition of entry, not a differentiator. It is increasingly important to have authentic and credible sustainable credentials "to enable you to even kind of get into the consideration set", but for the majority of consumers, it's an expectation. "Positioning ourselves purely as sustainable, unless there are additional benefits that you're bringing, is not going to position you as a brand or a product separately".

Read More:

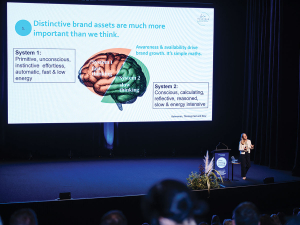

In terms of being ready to embrace change, Lulie talked of the importance of distinctive brand assets. Recognisable logos and brands can click with "system one" in our brains, "which is our primitive, unconscious, instinctive, effortless, automatic thinking," she said, "And that's where branding comes in. We see them at McDonald's golden arches, the Nike swoosh, the Apple lofo, and we don't have to do a lot of processing because we know what that means." The wine industry spends a lot of time asking its consumers to be in "system two" instead, which requires energy to process, "asking them to understand the detail of what we're doing". By having consistent and distinctive brand assets, tapping into system one, "we're bringing an advantage to our brands and our products".

Generational Nuances

Is Gen Z fundamentally different from previous generations, with little place for alcohol in their lives? Or are they simply young and broke, and going through life stages later than previous cohorts? If the former is the red group and the second is the blue, wine business strategist Lulie Halstead sees it in shades of purple. "There are some funadamental cohot generational differences," she said at the Wine Business Forum. "But there's also these life stage impacts. So, the future for us in wine may not be as doomed as the headlines are suggesting."