While all the focus was on the major correction in 2015-16 milk prices and the remedies by the two largest milk processors to address the impact of 'overpayment' on their businesses, any signals about expected future prices got lost. Projected 2016-17 milk prices seemed to come out largely as a shock in the past two weeks.

Frankly, for an industry with considerable worldliness and sophistication, that isn't good enough.

Perhaps the problem – the shock – is a combination of signals not being given clearly and not being read for what they are.

Farmers make the longest and largest capital investments in the dairy value chain and deserve much better certainty than the information currently provided.

The usual defence for the lack of forecasting of milk prices is that there is not enough information out there or insufficient certainty to provide a credible view. That once might have been a valid defence, but the world is now more transparent.

Information from competitor and importing regions is more readily accessible, and there are rsk management tools that provide commodity price signals.

The other major impediment now in play is the impact of 'forward-looking statements' on unit holder expectations.

If Murray Goulburn were to make a next-season price forecast, for example, that would amount to a dividend forecast and hence a price-sensitive item of information to investors in the MG unit trust.

The new structure has engendered more caution about giving milk suppliers a meaningful future price signal, and recent events will no doubt make the company even more cautious.

Without a price number or range from the largest buyer out in the air, others could be reluctant to either commit to a signal, let alone any firm guidance.

Distilling all the market information and chatter out there into a meaningful number for a farmer is not easy.

Domestic market notwithstanding, global dairy trade affects milk values in Australia due to our trade exposure, and the world market is increasingly complex with many moving parts.

Our business took on that challenge a couple of years ago and bought a platform to provide our customers here and overseas with a rolling two-year outlook for the global market.

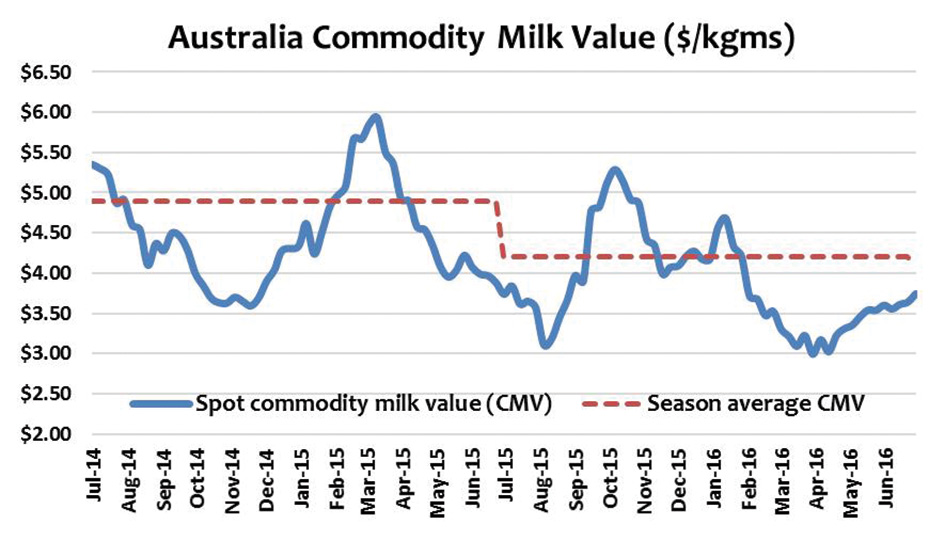

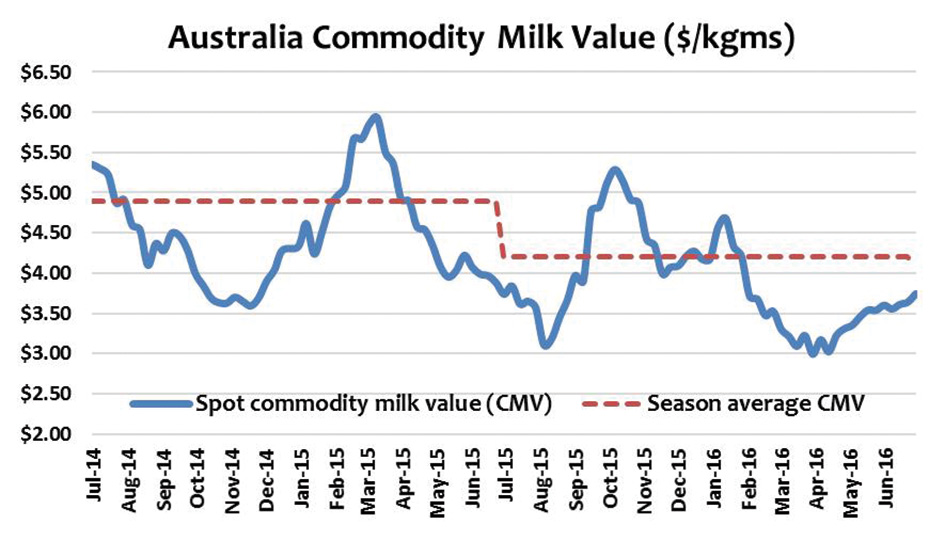

We have turned that outlook into a forecast commodity milk value – the expected farmgate value of the returns from a relevant mix of major commodity products, based on export prices, manufacturing costs and company margins.

A commodity milk value isn't the same as a farmgate milk price as Australian returns are typically higher than commodity values.

The wholesale prices achieved by dairy companies in the domestic market are more stable and smoother than prices achieved from exports.

In addition, Australian exports generally achieve a higher average price than product sold as bulk commodities as there is more tailored specification sought by customers.

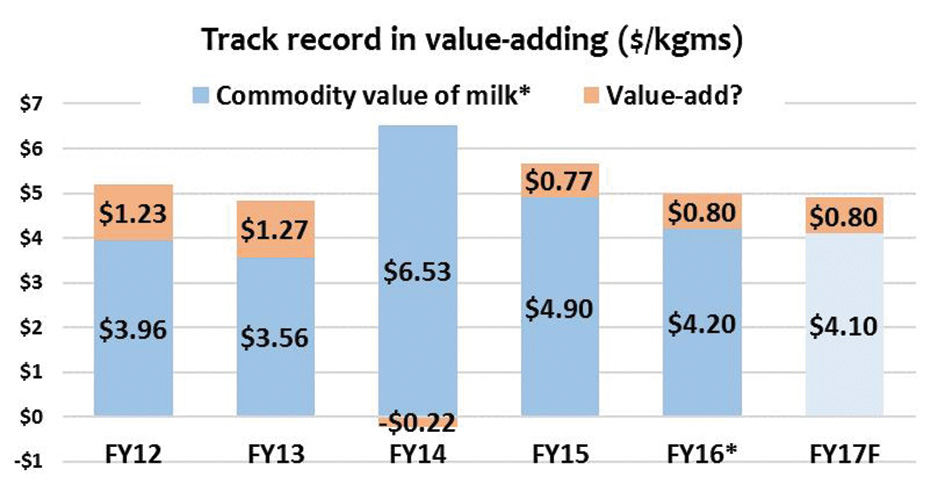

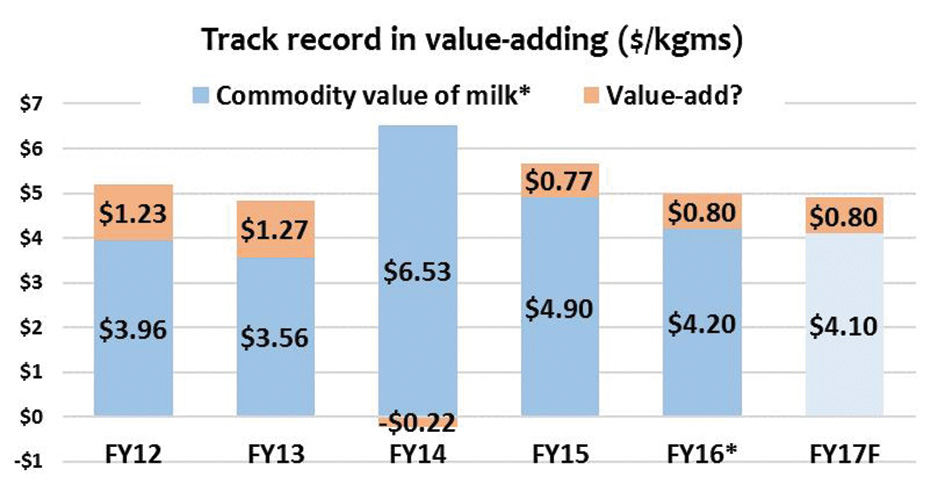

In the last couple of years, the difference between southern Australian milk prices and the commodity value of milk has been worth close to 80c/kgMS. The chart (left) shows the history of that difference.

In the last couple of years, the difference between southern Australian milk prices and the commodity value of milk has been worth close to 80c/kgMS. The chart (left) shows the history of that difference.

Interestingly it was higher in the past, suggesting that rather than adding value above commodities, net costs have been added.

We have used this global and local analysis to develop an estimate of 2016-17 full-season milk prices in a range of $4.80 to $5.20/kgMS for southern manufacturers, which we released in mid-May.

Companies have mostly announced full-year estimates in that range – although differences in product mix, market mix and performance can vary the actual payments.

Where is the commodity milk value going?

Where is the commodity milk value going?

In 2016-17 season, within the above number, we expect a value of just $4.10/kgMS.

Right now, our workings suggest the latest spot prices would convert to a commodity milk value (CMV in the chart to the left) of just $3.74/kgMS.

The market is in recovery and has a way to go before averaging $4.10/kgMS for the year.

In the following year, our projected commodity values for exports are currently much higher as the market is expected to recover.

Our 2017-18 season outlook currently sees a commodity milk value of about $5.20-5.60/kgMS; that should yield a farmgate price of $5.80-$6.30/kgMS.

The opportunity exists for the industry to systemise this process and its information, package it properly, track it for changes in global variables and make it available to dairy farmers so that decisions can be informed by well-founded future expectations. Forecasts have had a bad name lately.

Ours is built on an add-up of the world and a constant reading of the forward indicators of supply and demand. Take it for what it is -- better than nothing.

Here are some other thoughts on chatter out there at present.

• Steve Spencer is a director of Freshagenda, a Melbourne food industry consultancy.

In the last couple of years, the difference between southern Australian milk prices and the commodity value of milk has been worth close to 80c/kgMS. The chart (left) shows the history of that difference.

In the last couple of years, the difference between southern Australian milk prices and the commodity value of milk has been worth close to 80c/kgMS. The chart (left) shows the history of that difference. Where is the commodity milk value going?

Where is the commodity milk value going?